Going back to my previous article on managing implementation risk and why this is important to building your business further, I mentioned that knowledge was also a key component in this process.

Knowledge is a massive asset for any business. Some of it is written down or captured somehow, but most of it is “tacit” and inside either your head, or that of one of your partners or employees. How you manage your knowledge will have a significant impact on how successful you are in growing your business.

It is worth spending some time assessing what information you do have. Ask yourself the following questions:

- Can I get hold of it on a timely basis?

- When I do is it accurate?

- Is it meaningful and relevant?

- Can it be monitored, measured and compared to my targets?

- Does it enable me to take action?

The key issue to keep in mind at all times is that you want to create value in your business, so what information will help you achieve that?

I see a lot of businesses that suffer from “analysis paralysis” – they have more information than they can cope with and can’t strip out the key “nuggets” which will help with decision-making. Quite often, when you are wading through an established company’s board pack, you can figure out how they have done in the last month or quarter. But you wouldn’t necessarily know how they had achieved their results, what you could learn from them, and what should be done differently going forward to realise the full potential of the business.

Let’s consider value creation for a moment.

Wouldn’t it be good to grow value contributors to your business? By way of example, your more profitable products or services and customer types. Equally it would be helpful to reduce or eliminate value destroyers; the less profitable or unprofitable products, services and clients. In other words, you could improve the financial value of your business mix. You could also assess opportunities to sell more and improve margins, thus creating financial value from sales and operational efficiencies.

Another thing to look at is how you manage your net working capital. How could you achieve improvements in your cash management practices? Not forgetting debtor management, creditor management, and inventory control. You could also review and dispose of underperforming assets, such as property, machinery and so on. By doing this, you would be making better use of your capital.

Finally, you could review how you were funding the business and see whether you could make any financially attractive adjustments to your cost of capital.

Tracking all these aspects would be an invaluable discipline. You could capture these in some form of “dashboard”, so you could see at a glance what was working and what wasn’t, and take immediate corrective action. Another useful tool in this regard is the Balanced Scorecard, where typically you would measure how you were doing in 4 key areas of the business:

I know a mutual organisation that created a great little scorecard to ensure they were measuring their performance against the pledges they had made to their members. It is worth bearing in mind that profit was not their only measure of success.

The elements they measured were:

Finance:

- Number of members voting at AGM (refection of member support and engagement)

- Operating profit (to ensure their solvency and payment of a “divi” to their members

- Net interest margin (they wanted theirs to be lower than any of their competitors i.e. difference between the rate they would lend at and the rate they would pay on deposits)

Customers:

- Number of membership points per member (measure of relationship depth and breadth)

- Share of UK mortgage market (sign of operational and technical excellence)

- Customer advocacy (reflection of customer satisfaction)

Staff:

- Customer satisfaction with employee performance (customers happy with behaviour of employees)

- Employee engagement survey results (satisfaction with leadership and development)

- Position in national surveys (recognition of a good place to work)

Process:

- Cost:asset ratio (sign of cost-efficient systems and processes)

- Percentage improvement in processes over time (sign of continuous improvement)

- Number of compliance breaches (satisfying regulatory requirements)

If a “balanced” approach is taken to these areas of activity, then the chances of strategic objectives being hit is increased significantly.

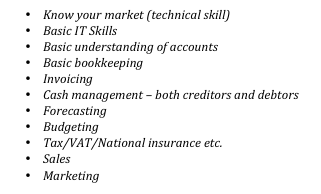

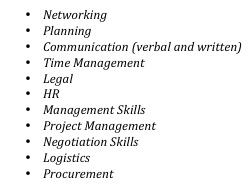

So now that you know how to properly use your knowledge to your advantage, it is time to look at another skill for growing your business, managing your finances.